Singapore’s dining and hospitality industry is known for its efficiency and exceptional service. Whether enjoying a meal at a high-end restaurant or staying at a luxury hotel, you might notice a 10% service charge added to your bill.

But what exactly does this charge cover, and how does it differ from tipping?

A service charge is a mandatory fee applied by many establishments in Singapore to cover operational costs, including staff wages and service expenses.

Unlike in some countries where tipping is customary, Singapore’s service charge is automatically included, ensuring consistency in service staff compensation. However, many consumers are unaware of how this charge is distributed or its legal implications.

This blog will break down the service charge in Singapore, its purpose, legal requirements, and what customers and business owners need to know. Understanding these details can help you make informed decisions the next time you dine out or book a hotel stay.

What is a Service Charge?

A service charge is a mandatory fee added to a customer’s bill by restaurants, hotels, and other hospitality establishments in Singapore.

Usually set at 10% of the total bill, this charge is intended to cover the cost of services provided, such as table service in restaurants or concierge assistance in hotels.

Unlike tipping, which is voluntary in some countries, a Singapore service charge is automatically applied and not at the customer’s discretion.

It’s important to note that the service charge is separate from the Goods and Services Tax (GST). While GST is a government-mandated tax (currently 9% in 2025), the service charge is implemented at the establishment’s discretion.

Guests should also be aware that, in addition to service charges, they may encounter other fees such as the hotel tax, which contributes to the overall cost of staying or dining in hospitality venues.

The purpose of a service charge is to help businesses manage operational costs, a crucial aspect of hotel revenue management, while ensuring fair compensation for service staff.

Some establishments use it to supplement wages, while others allocate it toward maintaining high service standards.

However, whether the collected service charge is directly distributed to employees depends on company policies, making it a topic of interest for consumers and workers in the hospitality industry.

Types of Service Charges

Service charges in Singapore’s hospitality industry can take various forms, depending on the establishment and the nature of the services provided.

While the 10% charge is the most commonly recognized fee in restaurants and hotels, businesses may implement other types of service charges to cover additional operational costs.

1. Mandatory Service Fees

These are fixed charges that customers must pay when dining at restaurants, staying at hotels, or using certain hospitality services.

The service charge typically falls into this category, with a standard 10% fee applied to most restaurant and hotel bills. This charge helps establishments cover staffing and service-related costs.

An example is a fine-dining restaurant in Singapore, where a 10% service charge is automatically included on every bill, ensuring service staff receive consistent compensation.

2. Discretionary Service Fees

Unlike mandatory fees, discretionary service fees are optional and left to the customer’s choice. Some high-end restaurants and hotels allow guests to add a gratuity for exceptional service, but tipping is uncommon in Singapore.

By enhancing guest satisfaction, these fees can help reduce guest acquisition costs through increased customer loyalty and positive word-of-mouth.

An example is a luxury spa that may suggest a 5% to 10% discretionary service charge for therapists, but guests can decide whether to pay it.

3. Administrative Fees

These charges cover paperwork, record-keeping, and processing costs, often seen in event venues, banquet halls, or travel-related services. Businesses apply these fees to manage bookings, contracts, or regulatory compliance.

For example, a hotel conference room booking may include a 3% administrative fee for handling reservations and paperwork.

4. Maintenance Fees

Maintenance fees help businesses fund repairs, equipment upkeep, and general facility maintenance. These are more common in membership-based establishments like clubs, resorts, and serviced apartments than standard restaurants.

For example, a private members’ club may charge an annual maintenance fee to cover renovations and upgrades to shared spaces.

5. Security Fees

Some venues and hotels impose security fees for safety measures, personnel, and surveillance systems. These charges ensure that guests and properties remain protected, especially at large-scale events or high-profile establishments.

Such fees are part of hotel ancillary revenue, allowing hotels to generate additional income while maintaining safety standards.

For example, a hotel hosting a large event may include a security fee in the room rate to cover the cost of security personnel and surveillance equipment.

Service Charges in Singapore’s Hospitality Industry

In Singapore, service charges are widely applied in the hospitality sector, especially in restaurants and hotels. While this practice is customary, it is not a legal requirement, meaning businesses can implement or waive the charge.

Most mid-to-high-end restaurants impose a 10% service charge on dine-in customers, which helps cover staffing and operational expenses.

This charge is different from the Goods and Services Tax (GST), currently at 9%, and both are typically added together on the bill. Customers often see the notation “++” on menus or pricing, indicating that service charge and GST will be applied separately.

Hotels in Singapore also commonly include a 10% hotel bill service charge, which applies to room rates, dining, and additional services such as spa treatments or room service. This charge contributes to maintaining service standards and ensuring fair employee compensation.

It is often based on the average room rate, contributing to the overall operational costs and hotel service quality.

However, some businesses choose alternative pricing strategies, such as incorporating service costs into their base prices or omitting service charges entirely in favor of discretionary tipping.

While service charges are a standard industry practice, consumers should always check their bills to understand how service charges work and ensure transparency in pricing.

Why Restaurants and Hotels Charge Service

Implementing a service charge in restaurants and hotels is based on several factors, including operational efficiency, fair staff compensation, cost predictability, and customer perception.

In Singapore, where tipping is uncommon, the service charge is essential in ensuring service staff receive fair compensation while helping businesses manage their operations more effectively.

1. Operational Efficiency

Service charges help businesses cover indirect costs not directly reflected in menu prices or accommodation rates. These costs include table setup, cleaning, kitchen preparation, and the work of front-of-house staff.

These essential services contribute significantly to the overall dining or lodging experience, yet they are not typically captured in the price of an individual item or service.

By imposing a service charge, establishments can ensure that these behind-the-scenes activities are properly funded, helping maintain operational efficiency without increasing menu prices.

2. Fair Staff Compensation

Another major reason for implementing a service charge is to provide fair compensation for both front and back-of-house staff. In Singapore, where tipping is not a common practice, service charges step in to fill the role of gratuity, ensuring that staff receive consistent and equitable pay.

The service charge is typically pooled and distributed among all employees, ensuring that everyone from servers to chefs is fairly compensated. This system is important in the hospitality industry, where wages might not always reflect the level of service provided.

3. Cost Predictability

Service charges help businesses predict their labor costs more effectively. Unlike tips, which vary greatly depending on customer generosity, service charges are fixed amounts that allow businesses to plan their expenses more reliably.

Knowing that a consistent 10% service charge will be applied across all bills helps ensure that employees are paid consistently and that businesses can budget for staffing costs more accurately. This reduces the potential for under-tipping, which can demotivate staff and create inequity.

4. Customer Perception

In many cases, businesses prefer to implement transparent service charges rather than rely on optional tipping. While tips vary widely depending on customer satisfaction, service charges create a consistent and predictable pricing structure.

Businesses can avoid customer confusion or frustration by clearly communicating the service charge upfront.

Additionally, service charges help ensure that employees are compensated regardless of whether a customer chooses to leave a tip. This approach helps maintain both customer satisfaction and employee morale.

Legal Framework and Consumer Rights

In Singapore, service charges are common in the hospitality sector, but consumers must understand their legal standing regarding these fees. While service charges are prevalent in restaurants and hotels, they are not legally required.

Businesses have the autonomy to decide whether to implement service charges and are free to determine the amount charged.

That being said, transparency is essential. Under Singapore’s consumer protection laws, establishments must communicate any additional charges, such as service fees.

This is usually done through menu notations, signage, or terms and conditions included in booking confirmations or bills. For example, the “++” notation on restaurant menus indicates that service charges and GST will be added to the listed prices.

As a consumer, it is your right to ask for clarification on any unclear charges. It’s essential to review your bill carefully to ensure that any service charge is correctly applied and inquire if any additional fees or charges are not explicitly mentioned.

If you feel a charge is not in line with the establishment’s policies or wasn’t properly disclosed, you can request an explanation or raise a complaint.

Being informed about your rights as a consumer helps you make educated decisions when dining out or staying in hotels, ensuring no surprises at the checkout.

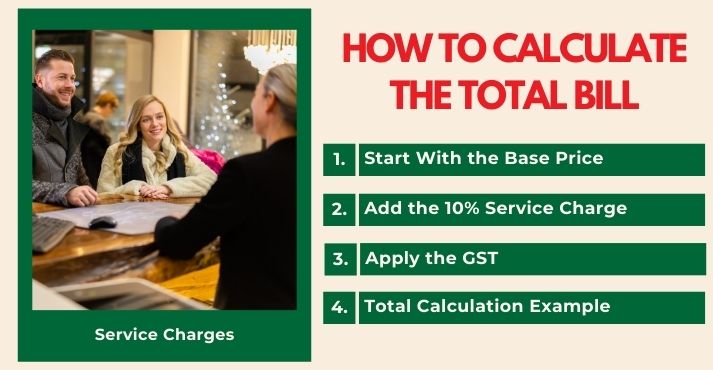

How to Calculate the Total Bill

Understanding how to calculate GST and service charges in Singapore’s hospitality sector ensures no surprises when it’s time to pay. Here’s a simple step-by-step guide to help you accurately calculate your total bill:

- Start with the base price: This is the price of your meal or room before any additional charges, such as service charges and GST.

- Add the 10% service charge: The service charge is usually 10% of the base price in restaurants and hotels in Singapore. This charge covers the cost of service-related activities, like staffing and maintenance.

- Apply the GST: Singapore’s Goods and Services Tax (GST) is 9%. The GST is calculated on the subtotal, which now includes the base price and the service charge.

- Total calculation example: Let’s break this down with an example.

- Base price: SGD 100 (for a meal or room)

- Service charge: 10% of SGD 100 = SGD 10

- Subtotal (base price + service charge): SGD 100 + SGD 10 = SGD 110

- GST (9% on subtotal): 9% of SGD 110 = SGD 9.90

- Total bill: SGD 110 + SGD 9.90 = SGD 119.90

In this example, you would pay SGD 119.90, including the 10% service charge and the 9% GST.

Conclusion

In Singapore, understanding service charges and GST is crucial when dining out or staying in hotels, as these charges directly affect the final amount on your bill.

Service charges, typically 10%, help cover operational costs and ensure fair compensation for staff, while the GST is applied to the subtotal (including the service charge).

Transparency from businesses and awareness from consumers is essential for avoiding confusion. Always check your bill to confirm the charges, and feel free to inquire about any unclear fees.

Being informed helps you understand the purpose of service charges and allows you to make confident decisions about your rights as a consumer. Stay vigilant, and always ask if something on the bill seems wrong.